Best Family Health Plans Bronze, Silver or Gold?

If you buy health insurance on a land or federal marketplace, the arrival of fall means it's almost time to pick a wellness plan. The Affordable Care Deed, also called Obamacare, requires most Americans to buy wellness insurance. This yr'due south open enrollment period lasts from November. 1 to January. 31 for anyone ownership health insurance on their own, whether for one person or a family. (If you get your wellness programme through work, your open up enrollment time will be decided by your employer.)

Health plans sold through the marketplaces are sorted into tiers — bronze, silver, gold or platinum — based on how much they will help pay your medical bills, on average.

Here'due south how to determine which tier is right for you.

Tiers give an gauge of how much a plan will pay

Each tier is meant to estimate the pct of medical costs the plans volition cover, based on an average across all buyers of plans inside the tier:

- Statuary plans: 60%

- Silver plans: 70%

- Aureate plans: eighty%

- Platinum plans: ninety%

Wellness plans inside every tier must pay for "ten essential health benefits," which are defined past federal police — things such every bit trips to the emergency room, pediatric care, prescription drugs and preventive care such equally physicals and immunizations. Plans can besides pay for handling beyond these 10 fundamentals, and the overall estimated payments for services make up one's mind the tier.

The percentage you pay for each tier (such as 40% for a bronze plan) includes your deductible, copayments and coinsurance. These amounts also volition vary by programme, even inside the same tier. There is a cap on how much you pay in one year that likewise varies by health plan; the maximum in 2017 is $vii,150 for an individual or $fourteen,300 for a family.

Step-by-pace: How to pick best Medicare Advantage program for you

This twelvemonth, "Simple Pick" plans will be available on the exchanges for some consumers. Deductibles, copayments and coinsurance are the aforementioned within each metallic tier in these plans to brand them easier to compare.

Silver and gold are a good middle ground

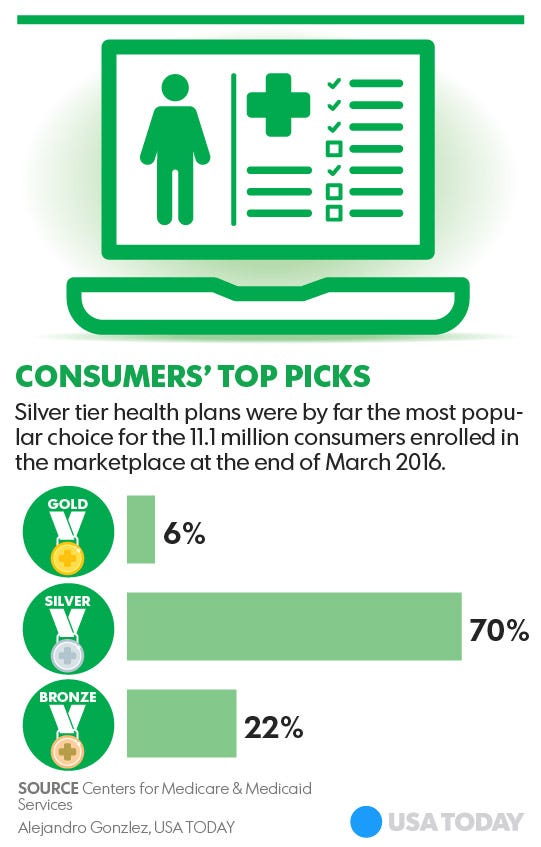

For many people, silver plans seem to strike a good balance between out-of-pocket costs and premiums. Of consumers enrolled in state or federal exchanges every bit of March 2016, lxx% choose a silver program, co-ordinate to the Centers for Medicare and Medicaid Services.

Philip Lee, a wellness insurance broker in Lafayette, Calif., says most of his clients choose argent plans. Nonetheless, people with more medical needs often upgrade to gold plans because lower costs at the doctor's function or pharmacy offset their higher monthly premiums.

Bronze and platinum plans might not pay off

After argent plans, bronze plans are the next most popular, with 22% of consumers choosing them in 2016 — perhaps because the premiums are often the everyman available.

The merchandise-off with a statuary programme is higher out-of-pocket costs when you're sick and need to run across a md or fill a prescription. "So if you lot're really salubrious and will hardly ever be using the plan at all, OK, maybe bronze is a proficient choice," Lee says.

A $122,000 mistake: Choosing bacon over retirement benefits

On the flip side, Lee well-nigh never recommends a platinum plan to clients because the added benefits typically aren't worth the high premiums. Merely 2% of consumers chose such plans.

"Don't get a plan you think you lot might not be able to afford," says Adria Gross, a patient abet and author of Solved! Curing Your Medical Insurance Problems. If you can't pay your premiums, the insurer will cancel your plan.

There'due south more to a programme than its metal tier

The metal tier is just one of many things to keep in mind when choosing a health plan. "If any plan doesn't cover your doctors, hospitals and your drugs, it won't work for you," says Gross. When making your choice, you should:

- Await at the summary of benefits for any plan yous're seriously considering. This certificate tells you what medical services the programme pays for and, perhaps more than important, those information technology does non pay for.

- Make sure you like the plan type. For example, a health maintenance organization, or HMO, will require y'all to accept a primary care doctor and get referrals for whatever specialists you lot want to come across. A preferred provider organization, or PPO, volition give you lot more leeway in choosing doctors.

- Check the plan's provider network directory to make sure your primary intendance dr. is listed, if you want to keep that dr.. You can as well telephone call your physician'due south office and ask whether they accept the specific program you're because.

- Check the plan'southward drug formulary, which is the list of covered drugs, to brand sure any prescription medications you lot accept are included.

If you don't detect this information online, phone call the insurer's client service line and ask any questions you take earlier you purchase.

MORE:Choosing between a depression- or loftier-deductible health program

More:Your stride-past-step guide to choosing a wellness insurance plan

More than:Your drug formulary: how information technology works and what to know

Lacie Glover is a staff writer at NerdWallet, a personal finance website. Email: lacie@nerdwallet.com . Twitter: @LacieWrites .

NerdWallet is a U.s. TODAY content partner providing general news, commentary and coverage from around the web. Its content is produced independently of United states of america TODAY.

Source: https://www.usatoday.com/story/money/personalfinance/2016/10/30/bronze-silver-gold-health-insurance-tier/92666622/

0 Response to "Best Family Health Plans Bronze, Silver or Gold?"

Post a Comment